When evaluating motor investments for industrial applications, the cost comparison between a 3.3 kV motor and standard low-voltage alternatives reveals significant long-term financial implications. High-voltage motors typically demand higher upfront capital but deliver substantial operational savings through reduced current draw, lower cable costs, and enhanced efficiency ratings. Standard motors operate at 380V-690V, while 3.3 kV motor systems function at elevated voltage levels, creating distinct economic profiles that impact total cost of ownership across manufacturing, energy generation, and process control industries.

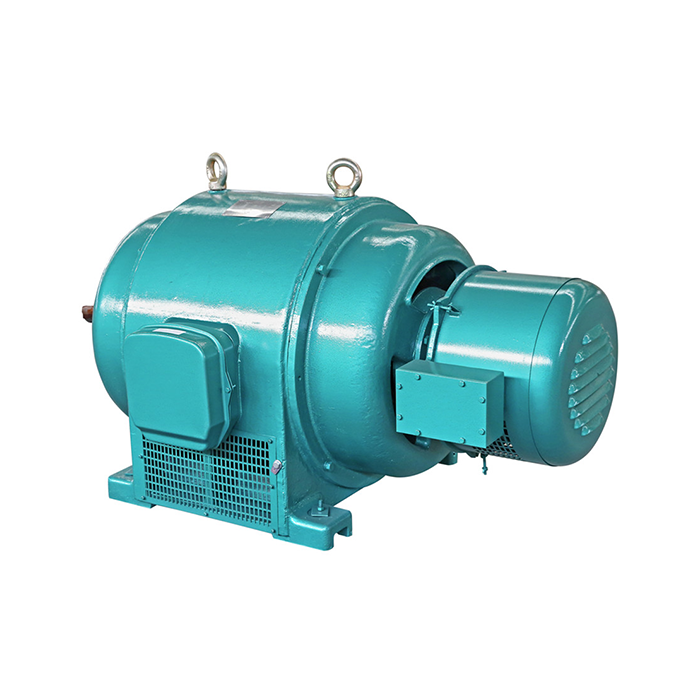

Series:Y2

Protection level:IP54

Voltage range:3000V±5%,3300V±5%,6000V±5%,6600V±5%,10000V±5%,11000V±5%

Power range:160-1600 kW

Application:fans, water pumps, compressors, crushers, cutting machine tools, transportation machinery, etc.

Advantage:compact structure, light weight, low noise, small vibration, long service life, easy installation and maintenance.

Standard: This series of products complies withJB/T10444-2004 standards.

Others: SKF, NSK, FAG bearings can be replaced according to customer requirements.

Global Price Breakdown for High-Voltage Motors

Factory Pricing Structure and Market Positioning

High-voltage motor pricing varies considerably across global markets, with factory FOB prices ranging from $8,000 to $45,000 for industrial-grade units between 160kW and 1600kW capacity. Chinese manufacturers typically offer competitive pricing at $50-65 per kilowatt, while European suppliers command premium rates of $85-120 per kilowatt. CIF pricing includes additional freight costs averaging $1,200-3,500, depending on destination and motor size.

Minimum Order Requirements and Volume Discounts

Manufacturing offices, for the most part, build up MOQ limits at 5-10 units for standard setups. Volume acquiring understandings open dynamic markdown structures, with 15-unit orders securing 8-12% diminishments and 50-unit commitments accomplishing 18-25% investment funds. Custom details may increase MOQ prerequisites to 20 units due to specialized fabricating processes.

Additional Cost Considerations

Import obligations vacillate between 6.5% and 15% over distinctive locales, whereas customs clearance expenses include $350-800 per shipment. Marine protection ordinarily costs 0.3-0.6% of cargo esteem. Specialized dealing with hardware for larger-than-average engines may require an extra $500-1,500 coordinations charges. Cash supporting methodologies offer assistance moderate trade rate instability influencing the last landed costs.

Market Dynamics Influencing Motor Pricing

Raw Material Cost Pressures

Raw fabric instability remains one of the most powerful drivers of engine estimating, particularly for applications including medium-voltage hardware such as a 3.3 kV motor. Copper accounts for a significant portion of stator and rotor winding costs, and cost motions between $8,200 and $10,500 per metric ton can move by and large generation costs by 12–18%. Steel laminations, speaking to generally one-quarter of to fabrication, are similarly delicate to worldwide supply patterns and cargo changes. For permanent-magnet plans, uncommon soil materials present premium cost layers due to geopolitical limitations and restricted worldwide refining capacity. Labor fetched crevices between major generation regions—such as Southeast Asia, India, and Eastern Europe—further impacting the last estimating structures. These combined components compel producers and acquisition groups to persistently reassess sourcing methodologies to keep up taken a toll competitiveness.

Seasonal Demand Patterns

Seasonal acquisition cycles also have a quantifiable impact on engine estimating behavior across worldwide mechanical segments. Request regularly rises in Q2 and Q3 as producers start gear overhauls, plant extensions, and mechanization ventures, resulting in fixed supply and upward cost alterations. The vitality industry, which regularly conveys medium-voltage frameworks counting 3.3 kV motor units, takes after yearly budget-driven acquiring cycles that escalating buying weight amid Q4. Territorial components increase these impacts: Chinese Unused Year slowdowns can disturb upstream component accessibility, whereas European summer occasions diminish generation capacity and coordination throughput. These unsurprising imperatives frequently trigger short-term cost increments of 5–8%. Buyers arranging large-scale procurement or multi-site hardware standardization must carefully adjust obtaining plans with these regular designs to minimize fetched exposure.

Regional Price Comparisons and Market Analysis

Asian Manufacturing Hub Advantages

Chinese engine producers keep up taking a toll on authority through coordinated supply chains and economies of scale financial matters. Vietnamese providers offer competitive choices with 8-15% higher estimates but decreased lead times. Indian producers center on particular control ranges with estimates situated between Chinese and European alternatives.

European Premium Positioning

German and Italian producers command a premium estimating to their advanced design capabilities and specialized applications mastery. Their items ordinarily take a toll 40-60% more than Asian options but convey prevalent execution in requesting situations. Scandinavian providers exceed expectations in cold-weather applications by comparing cost premiums.

Strategic Procurement Optimization

Effective Negotiation Approaches

Effective motor procurement relies on presenting detailed technical specifications, operational parameters, and performance expectations to ensure accurate quotations and avoid cost inflation later in the process. Buyers who establish multi-year partnership agreements typically secure more stable pricing compared to spot purchasing, as suppliers can plan production and material sourcing more efficiently. For medium-voltage equipment such as a 3.3 kV motor, clarity on insulation class, cooling type, protection level, and starting method significantly strengthens negotiation leverage because it reduces engineering ambiguities. Payment structures also influence final pricing: suppliers commonly offer 3–5% discounts for 30% advance payments due to improved cash flow, whereas letter-of-credit terms introduce additional banking fees. Incorporating volume forecasts, phased delivery schedules, and shared inventory strategies further enhances negotiation outcomes by reducing financial risk for both parties.

Customization Cost Management

Managing customization costs is essential, particularly when dealing with specialized applications that may require unique design considerations for equipment such as a 3.3 kV motor. OEM-level modifications—whether related to shaft dimensions, terminal box orientation, cooling enhancements, or non-standard protection features—can increase the base price by 15–35%. Standardizing mounting arrangements, electrical interfaces, and accessory configurations across multiple motor models or sites significantly reduces engineering hours and production adjustments, lowering customization premiums. Early engagement with suppliers during the system design phase allows both sides to refine specifications before manufacturing constraints lock in, ensuring that performance requirements are met without unnecessary cost drivers. Coordinated technical reviews, sample drawings, and prototype evaluations also prevent rework, enabling a more cost-efficient procurement cycle.

Future Market Projections

Economic Indicators and Pricing Trends

Inflation pressures across major manufacturing economies suggest continued price escalation of 4-7% annually through 2025. Trade policy developments may introduce additional tariff considerations affecting import costs. Energy transition investments are driving increased demand for high-efficiency motors, potentially supporting pricing stability.

Technology Evolution Impact

Advanced motor designs incorporating smart monitoring capabilities may command premium pricing initially but offer superior lifecycle value propositions. Manufacturing automation improvements could moderate cost increases in medium-voltage motor segments. Sustainable materials development may introduce new cost variables in coming years.

Cost-Benefit Analysis Framework

Total Cost of Ownership Calculations

High-voltage motors deliver operational advantages that often justify higher acquisition costs. Reduced current requirements decrease cable sizing needs by 40-60%, creating substantial infrastructure savings. Lower transmission losses improve overall system efficiency by 2-4%, generating significant energy cost reductions over 15-20 year service lives.

Maintenance and Reliability Considerations

Premium motor designs typically require less frequent maintenance interventions, reducing lifecycle costs. Advanced bearing systems and improved insulation materials extend service intervals and enhance reliability metrics. Properly sized high-voltage applications often demonstrate superior longevity compared to oversized low-voltage alternatives.

Conclusion

The taken a toll examination between 3.3 kV motor frameworks and standard low-voltage choices uncovers complex financial contemplations expanding past starting buy costs. Whereas high-voltage engines require more prominent forthright venture, their operational benefits make compelling add up to taken a toll preferences in suitable applications. Worldwide estimating varieties offer openings for vital sourcing, with Asian producers giving competitive alternatives and European providers conveying premium arrangements. Fruitful acquirement methodologies adjust beginning costs with long-term execution necessities, considering components such as vitality effectiveness, support needs, and framework integration complexity. Showcase patterns propose proceeded advancement in engine innovation and estimating structures, making intensive investigation basic for ideal speculation decisions.

Frequently Asked Questions

Q1: What factors determine whether a 3.3 kV motor is more economical than standard voltage alternatives?

A: The economic advantage depends on several key factors including power requirements, operating hours, energy costs, and installation complexity. High-voltage motors become more cost-effective for applications above 500kW with continuous operation patterns. Cable cost savings and reduced transmission losses typically justify the premium for large installations.

Q2: How do global supply chain disruptions affect motor pricing and availability?

A: Supply chain interruptions can increase lead times from standard 8-12 weeks to 16-20 weeks and add 10-15% to pricing. Raw material shortages particularly impact copper-intensive designs. Maintaining relationships with multiple suppliers across different regions helps mitigate these risks.

Q3: What warranty and service considerations should be evaluated when comparing motor costs?

A: Standard warranties typically cover 12 months from shipment or installation. Extended warranty options add 3-6% to initial costs but provide valuable protection. Local service network availability significantly impacts total cost of ownership, making supplier service capabilities important selection criteria.

Get Expert Motor Solutions from XCMOTOR

XCMOTOR delivers comprehensive high-voltage motor solutions tailored to your specific industrial requirements. Our experienced engineering team provides detailed cost analysis and application guidance to ensure optimal motor selection for your projects. Whether you need a reliable 3.3 kV motor manufacturer for large-scale installations or custom solutions for specialized applications, we combine competitive pricing with exceptional technical support. Our motors from 160–1600 kW and 3–11 kV support industrial, HVAC, and energy applications, using SKF/NSK/FAG bearings and IP54 designs for reliable, long-life performance in demanding environments.

Transform your motor procurement strategy with XCMOTOR's expertise and competitive solutions. Our dedicated support team operates seven days a week to address your technical questions and project requirements. Experience the difference that quality engineering and responsive service make for your operations. Ready to optimize your motor investments? Contact us at xcmotors@163.com or visit motorxc.com for detailed specifications and pricing information.

References

1. Industrial Motor Market Analysis Report 2024, Global Electric Motor Industry Association

2. High Voltage Motor Cost Optimization Study, International Electrotechnical Commission Technical Report

3. Energy Efficiency Standards for Industrial Motors, IEEE Standard 841-2021

4. Global Motor Manufacturing Cost Structure Analysis, Electric Power Research Institute

5. Supply Chain Risk Assessment for Electrical Equipment, International Trade Commission Report

6. Motor Lifecycle Cost Analysis Methodology, National Institute of Standards and Technology Publication