Understanding the complete financial commitment behind Medium Voltage Induction Motor ownership extends far beyond the initial purchase price. Total cost of ownership encompasses acquisition costs, installation expenses, operational efficiency, maintenance requirements, and end-of-life considerations. Industrial facilities investing in these critical power transmission systems must evaluate voltage ranges from 3kV to 11kV with power outputs spanning 185kW to 1800kW. Strategic procurement decisions require comprehensive analysis of upfront investments, energy consumption patterns, reliability factors, and long-term operational expenses to maximize return on investment across diverse applications including manufacturing automation, HVAC systems, and utility operations.

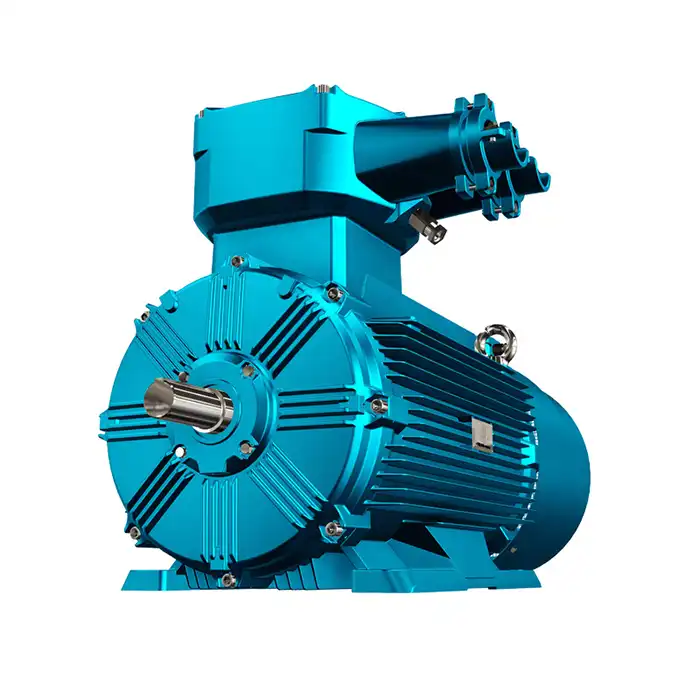

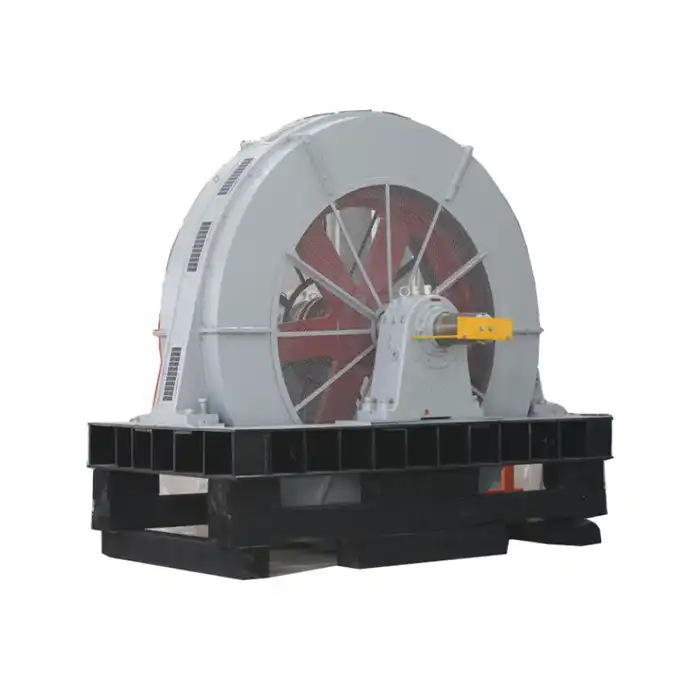

Series:YBBP-HV

Voltage range:3000V±5%,3300V±5%,6000V±5%,6600V±5%,10000V±5%,11000V±5%

Power range:185-1800 kW

Application:compressors, water pumps, crushers, cutting machine tools, transportation machinery.

Advantage: wide modulation range, high efficiency and energy saving, low noise, long life, high reliability.

Others: SKF, NSK, FAG bearings can be replaced according to customer requirements.

Current Market Pricing Landscape for Medium Voltage Motors

Global Factory Price Ranges and Regional Variations

Factory pricing for medium voltage electric motors varies widely across global manufacturing hubs. Chinese manufacturers typically offer FOB prices at relatively competitive levels, depending on power ratings and technical specifications. European producers usually command higher premium pricing for comparable three-phase systems, reflecting advanced engineering standards, brand value, and stringent quality certifications.

CIF pricing adds noticeable logistics costs to base factory rates, as transportation and insurance for heavy industrial motors can be significant and vary by destination market. Asian manufacturers often maintain cost advantages through optimized supply chains and efficient production processes, while Western suppliers tend to emphasize technological innovation, advanced electromagnetic design, and long-term performance reliability.

Minimum Order Quantities and Volume Discount Structures

Most producers build up MOQ necessities between 5 and 10 units for standard setups. Custom determinations frequently increment least orders to 20-50 units, especially for specialized winding arrangements or interesting rotor plans. Volume rebates regularly start at 15% for orders surpassing 50 units, scaling to 25-30% for amounts over 200 motors.

Bulk acquisition procedures empower noteworthy decreases through solidified shipping, standardized determinations, and decreased regulatory overhead. In any case, stock carrying costs and out-of-date quality dangers must be adjusted against volume investment funds, particularly for offices with changing inventory requirements.

Hidden Costs and Additional Expenses

Import duties vary depending on the country of origin and the destination market’s trade agreements, generally representing a moderate percentage of the total equipment value. Customs clearance fees add an additional cost per shipment, while insurance coverage for standard marine transit is typically calculated as a small proportion of the cargo value.

Installation expenses often surpass the initial Medium Voltage Induction Motor purchase cost, especially in retrofit projects that require upgrades to existing electrical infrastructure. Professional commissioning services also contribute noticeably to the overall budget, with costs influenced by system complexity and the level of integration required with current power supply networks.

Key Factors Influencing Medium Voltage Motor Pricing

Raw Material Cost Fluctuations

Copper estimating specifically impacts winding costs, accounting for 15-25% of add up to fabricating costs. Later copper showcase instability has driven cost swings of 20-40% inside yearly cycles. Steel costs influence stator and outline fabrication, whereas uncommon soil components impact lasting magnet applications in specialized designs.

Insulation fabric quality altogether influences the estimation of structures. Lesson F separator frameworks command premium estimating over standard Lesson B choices, but convey prevalent warm assurance and expanded operational life in requesting mechanical environments.

Labor and Manufacturing Efficiency

Skilled specialist accessibility impacts territorial estimating elements. Nations with built-up electrical fabricating skill keep up fetched points of interest through experienced workforce capabilities and refined production forms. Robotization ventures in cutting-edge offices diminish labor substance whereas moving forward consistency and quality standards.

Exchange Rate Impact and Economic Policies

Currency changes make estimating vulnerability for worldwide acquisition. Multi-year supply agreements frequently incorporate supporting components to stabilize costs. Government mechanical arrangements, counting send out motivations and natural controls, impact producer estimating methodologies and showcase competitiveness.

Supply chain disturbances have highlighted the significance of territorial sourcing procedures. Nearshoring patterns are slowly reshaping estimating flow as buyers prioritize conveyance unwavering quality over supreme fetched minimization.

Operational Cost Analysis and Efficiency Considerations

Energy Consumption and Efficiency Ratings

Energy costs add up to proprietorship costs over a normal long-term engine lifecycle. High-efficiency engines with premium effectiveness appraisals can significantly diminish energy consumption compared with standard plans. The coming about annually vitality reserve funds are frequently considerable enough to legitimize higher introductory ventures over numerous mechanical applications.

Compatibility with variable recurrence empowers extra vitality optimization opportunities. VFD-ready engines back adaptable speed control procedures that can essentially lower energy consumption in variable-load applications such as pumps and compressors, resulting in significant productivity picks up and long-term operational cost reductions.

Maintenance Requirements and Reliability Factors

Predictive maintenance programs help minimize unexpected downtime and associated costs. Premium bearing systems from manufacturers such as SKF, NSK, and FAG extend service intervals and lower overall maintenance expenses. Bearing replacement costs can vary widely depending on Medium Voltage Induction Motor size and bearing specifications.

Vibration monitoring systems support condition-based maintenance strategies by identifying potential issues at an early stage. Early fault detection helps prevent catastrophic failures that could otherwise lead to substantial production losses in critical process applications.

Regional Price Comparisons and Competitive Analysis

Asia-Pacific Manufacturing Advantages

Chinese manufacturers leverage economies of scale and integrated supply chains to offer competitive pricing. Quality improvements over the past decade have narrowed performance gaps with Western competitors. Delivery lead times typically range from 8-16 weeks for standard configurations.

Indian manufacturers are emerging as competitive alternatives, particularly for cost-sensitive applications. Local content requirements in various markets favor regional production capabilities over imported solutions.

European Premium Positioning

German and European manufacturers maintain technology leadership in specialized applications requiring extreme reliability and precision. Premium pricing reflects superior engineering capabilities, comprehensive testing protocols, and extensive certification compliance.

Local support infrastructure and rapid service response justify higher costs for mission-critical installations where downtime costs exceed equipment premiums.

Strategic Procurement Optimization Techniques

Supplier Negotiation Best Practices

Long-term partnership agreements enable better pricing through volume commitments and reduced supplier risk. Technical specification standardization across facilities creates procurement leverage and reduces inventory complexity.

Multi-source strategies balance cost optimization with supply security. Qualifying 2-3 approved suppliers for each motor category ensures competitive pricing while maintaining backup capacity for critical applications.

Custom Configuration Cost Management

OEM partnerships for high-volume custom applications can reduce costs by 15-30% compared to catalog products. Engineering collaboration during design phases optimizes specifications for cost-effectiveness without compromising performance requirements.

Modular design approaches enable cost-effective customization through standardized base platforms with application-specific modifications. This strategy reduces engineering costs while maintaining flexibility for diverse operational requirements.

Future Pricing Trends and Market Outlook

Technology Evolution Impact

Smart Medium Voltage Induction Motor technologies incorporating IoT sensors and condition monitoring capabilities are commanding premium pricing. These advanced features enable predictive maintenance strategies that reduce total ownership costs despite higher initial investments.

Energy efficiency regulations continue driving demand for premium efficiency motors. Regulatory compliance requirements may eliminate lower-efficiency options from markets, potentially affecting pricing structures for remaining products.

Supply Chain Resilience Considerations

Geopolitical tensions and trade policy uncertainties are influencing procurement strategies. Regional manufacturing expansion may increase pricing in the short term while improving supply security and reducing logistics risks.

Sustainability requirements are creating new cost considerations including carbon footprint assessment and end-of-life recycling capabilities. Green procurement policies may favor suppliers with comprehensive environmental programs despite potential cost premiums.

Conclusion

Comprehensive medium voltage engine fetched investigation uncovers that add up to proprietorship costs expand distant past starting buy costs. Vitality effectiveness contemplations, support prerequisites, and unwavering quality components altogether impact long-term money related execution. Savvy obtainment methodologies combining volume optimization, provider associations, and innovation assessment empower considerable fetched decreases whereas keeping up operational excellence.

Successful engine speculations require adjusting upfront costs against operational effectiveness and upkeep costs. Premium productivity engines with progressed checking capabilities regularly convey prevalent add up to taken a toll of possession in spite of higher starting costs. Key arranging and comprehensive seller assessment guarantee ideal obtainment choices for differing mechanical applications requiring dependable, proficient control transmission solutions.

Frequently Asked Questions

Q1: What factors contribute most significantly to medium voltage motor total cost of ownership?

A: Vitality utilization speaks to 70-80% of add up to possession costs over ordinary engine lifecycle. Effectiveness appraisals, stack profiles, and working hours specifically affect vitality costs. Upkeep costs, counting bearing substitution and preventive maintenance, regularly account for 10-15% of add up to costs. Beginning by cost speaks to as it were 10-20% of lifetime costs for most mechanical applications.

Q2: How do import duties and logistics costs affect international procurement pricing?

A: Consequence obligations run from 7.5% to 15% depending on exchange assurances and the nation of origin. Shipping costs include $800 to $2,500 per unit for sea cargo, whereas discussing transport can increase costs by 300-500%. Protections, traditions clearance, and taking care of expenses contribute extra 2-4% of item esteem. Add up to coordination costs regularly include 15-25% to plant estimating for worldwide purchases.

Q3: What maintenance cost savings can be achieved with premium bearing systems?

A: Premium bearing solutions from SKF, NSK, and FAG manufacturers significantly extend service intervals compared with standard bearings. Routine maintenance budgets are typically reduced on a yearly basis due to lower labor requirements and longer replacement cycles. Improved reliability helps prevent unexpected downtime, which in critical process applications can otherwise lead to substantial production losses and operational disruptions.

Partner with XCMOTOR for Competitive Medium Voltage Motor Solutions

XCMOTOR delivers exceptional value through our comprehensive medium voltage induction motor supplier capabilities, combining competitive pricing with superior quality standards. Our extensive product portfolio spans 185kW to 1800kW power ranges with voltage options from 3kV to 11kV, supporting diverse industrial automation, HVAC, and utility applications.

Discover how our Medium Voltage Induction Motor solutions can optimize your operational efficiency and reduce total ownership costs. Contact our engineering team today at xcmotors@163.com for detailed pricing analysis and customized recommendations.

References

1. International Energy Agency. "Energy Efficiency in Electric Motor Systems: Technology Roadmap and Implementation Guide." IEA Publications, 2023.

2. Institute of Electrical and Electronics Engineers. "IEEE Standard 841-2021: Standard for Petroleum and Chemical Industry - Premium Efficiency Severe Duty Totally Enclosed Fan-Cooled Motors." IEEE Standards Association, 2021.

3. McKinsey Global Institute. "Industrial Automation Equipment Global Market Analysis: Cost Structures and Procurement Trends." McKinsey & Company Research, 2023.

4. National Electrical Manufacturers Association. "NEMA MG 1-2021: Motors and Generators Standard - Medium Voltage Motor Specifications." NEMA Standards Publication, 2021.

5. Bloomberg New Energy Finance. "Global Industrial Electric Motor Market: Pricing Analysis and Total Cost of Ownership Assessment." BNEF Industrial Equipment Report, 2023.

6. International Electrotechnical Commission. "IEC 60034-30-1:2014 Rotating Electrical Machines - Part 30-1: Efficiency Classes of Line Operated AC Motors." IEC Standards Database, 2022.